By Jim Cline and Kate Kremer

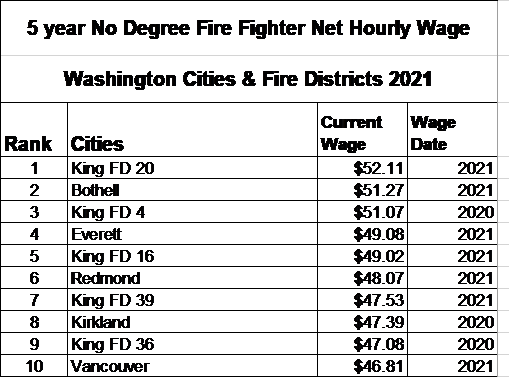

This is Part 7 of our multi-part 2021 Wage Series. In our last article, we covered Commissioned Deputy and Police Officer Wages. In this article, we turn to Firefighter and Corrections Officer Wages. We’ll cover Dispatcher and Records Clerk Wages in the next article.

[Read more…]

This is the fifth in our extensive series on current negotiation conditions and trends. In this article, we focus on recent economic developments.

This is the fifth in our extensive series on current negotiation conditions and trends. In this article, we focus on recent economic developments.