By Jim Cline

In our past two newsletters, we’ve discussed the continuation of higher-than-expected inflation. Those articles identified the prediction by economists earlier this year for the mid-year 2023 national inflation to subside to 3.6% and our doubts that those predictions will materialize. We are now expecting the June CPI numbers to be closer to 5% nationally and higher for the Seattle indices.

In our past two newsletters, we’ve discussed the continuation of higher-than-expected inflation. Those articles identified the prediction by economists earlier this year for the mid-year 2023 national inflation to subside to 3.6% and our doubts that those predictions will materialize. We are now expecting the June CPI numbers to be closer to 5% nationally and higher for the Seattle indices.

In our

In our

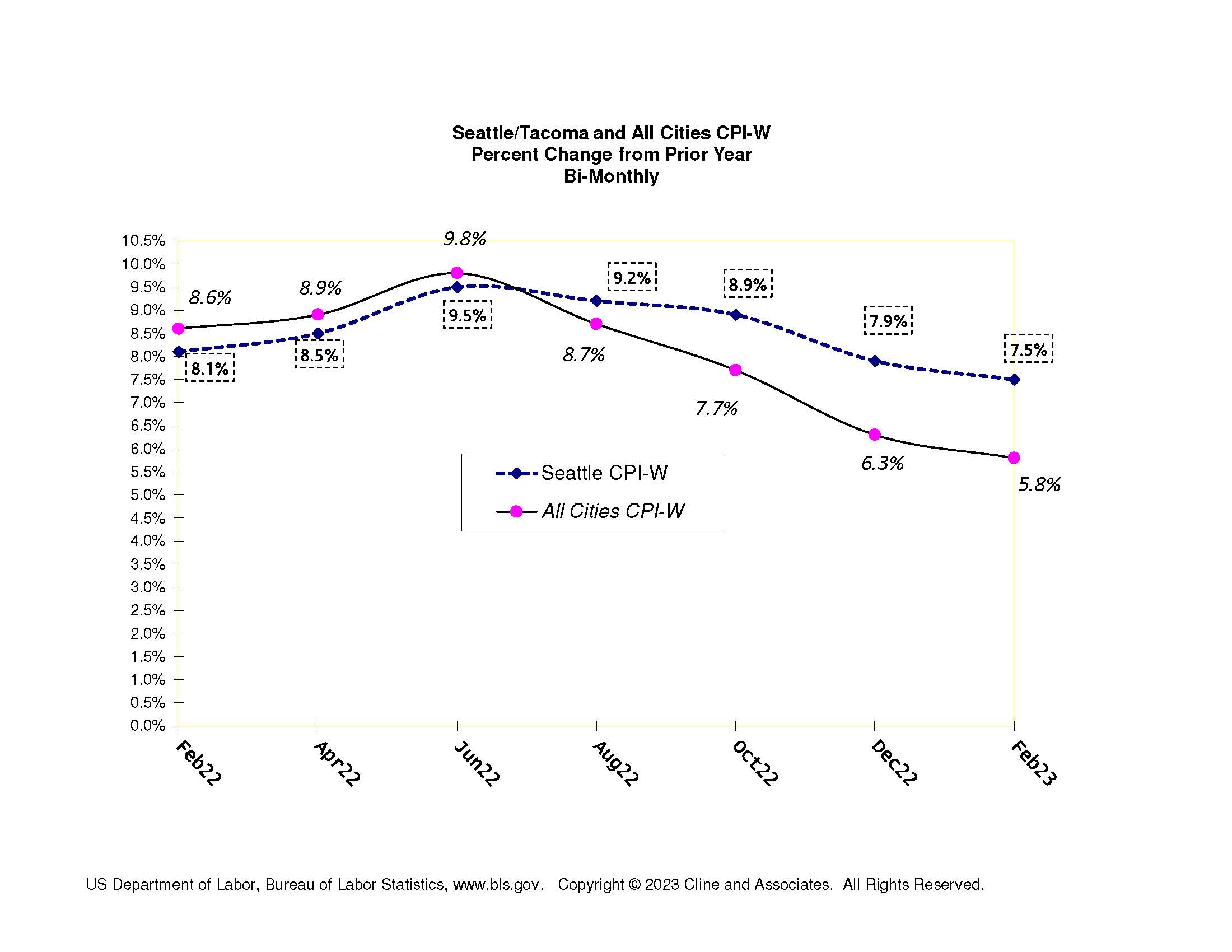

The latest CPI report continued to show high inflation numbers, even higher than the previous set. But inside those numbers were signs that the predicted slowdown in inflation may lie ahead. The Seattle 12-month through April to April “W” index was reported at an eye-popping 8.1%. The All-Cities index was even higher at 8.6%:

The latest CPI report continued to show high inflation numbers, even higher than the previous set. But inside those numbers were signs that the predicted slowdown in inflation may lie ahead. The Seattle 12-month through April to April “W” index was reported at an eye-popping 8.1%. The All-Cities index was even higher at 8.6%: