By Jim Cline and Kate Kremer

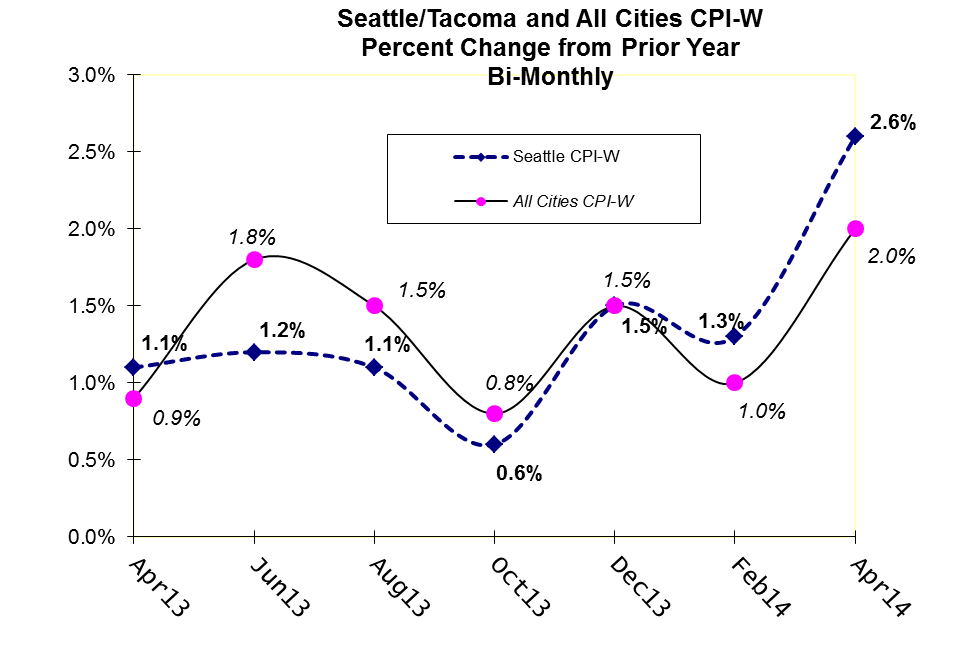

Last week’s BLS Report revealed a significant jump in the inflation rate. The April All Cities index was 2.0%, up from 1.0% in February. The Seattle index jumped from 1.3%, to 2.6% during the same two-month period. The numbers show CPI edging up over the past year:

Last week’s BLS Report revealed a significant jump in the inflation rate. The April All Cities index was 2.0%, up from 1.0% in February. The Seattle index jumped from 1.3%, to 2.6% during the same two-month period. The numbers show CPI edging up over the past year:

Given recent reports on rising energy and food prices, some type of jump was not unexpected, but the magnitude of the jump was somewhat of a surprise. As the Bureau of Labor Statistics explained:

The indexes for gasoline, shelter, and food all rose in April and contributed to the seasonally adjusted all-items increase. The gasoline index rose 2.3 percent; this led to the first increase in the energy index since January, despite declines in the electricity and fuel oil indexes. The food index rose 0.4 percent for the third month in a row, as the index for meats rose sharply.

The National index for all items other than food and energy only rose .2 from its previous month.

The last year of inflation reports have been surprisingly modest, something we discussed last year. In that blog, we tried to explain why the Fed kept missing its 2% inflation target.

With this latest batch of data, it appears that inflation close to 2%, if not a bit higher, has returned. The new numbers also appear to restore the Seattle index to its more common position of slightly outrunning the National index. As we explained last year:

We have indicated preference for the Seattle index over the national index based on past trends and future expectations. (Visit our Premium Website for our historic data on the All Cities and Seattle CPI.) Often employers will express the inverse desire to use the “All-Cities” (national) index. ….. You inherently are always gambling whenever you adopted a particular index — or elect a fixed percentage in lieu of a CPI formula — but we continue to think that for the foreseeable future, the Seattle index is a better bet than the All-Cities index.

The graph above reveals the past year of data for the Seattle and All-Cities W index. The chart below shows the data for other indices sometimes used in Washington labor contracts:

| CPI INDEX* | CPI-W | CPI-U |

| All-Cities (Apr 2014) | 2.0% | 2.0% |

| Seattle (Apr 2014) | 2.6% | 2.4% |

| West Coast (Apr 2014) | 1.7% | 1.8% |

| West Coast-Class B/C (Apr 2014) | 0.8% | 0.7% |

| Portland -Salem (Second Half 2013) | 1.0% | 0.9% |