By Jim Cline and Kate Kremer

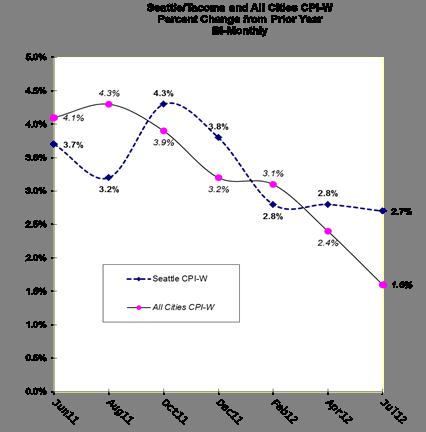

The Bureau of Labor Statistics has released its awaited June CPI report and it reveals that the National All-Cities index has moderated more than the Seattle index. The Seattle June CPI-W was reported at 2.7%, more than a point ahead of the June All Cities CPI-W which was reported at 1.6%. In both cases, these indices dropped significantly from last June when inflation was running near 4%. This chart shows the last 12 months of CPI-W data.

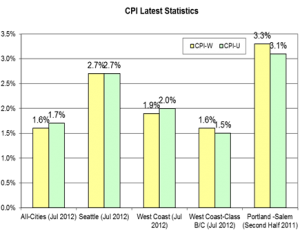

The June indices are an important factor and barometer of upcoming settlement trends. A large number of Washington public sector contracts, especially for interest arbitration eligible bargaining units, rely on the June indices. Here’s a chart showing the Seattle and All-Cities W numbers alongside some other relevant West Coast numbers:

As our long term readers are aware, we have recommended adopting the Seattle index over the National index. While there is an ebb and flow in the dueling sets of numbers, the Seattle index has historically outperformed the All-Cities index and we anticipate that trend will resume with the number of reports and indicators revealing that the Seattle economy will outgrow the national economy in the near term. That more rapid growth is anticipated to place inflationary pressures on housing and wages.

Historically, CPI has averaged around 3% but more recently, apart from the blip in mid-2011, inflation has been lower. The Federal Reserve bank predicts inflation to continue in the approximate range of 2% through at least 2014.

We have been observing a trend in contract negotiations that place less emphasis on the CPI index. The recent volatility in both the CPI and the uncertainty in the economic recovery have led to an increase frequency in short term agreements tied to a number of factors beyond CPI.

In the near future we will be releasing a detailed mid-year 2012 wage settlement report. So far the 2012 settlements, while higher than the settlements in 2010 and 2011 are falling far short of the 4% inflation reported in last June’s inflation numbers. Settlement averages for 2012 are most commonly in the 2.5 to 3% range. We would expect that, dependent on other economic and fiscal developments, 2013 settlements will average between 2 and 2.5 percent. But more on that later.