By Jim Cline and Kate Kremer

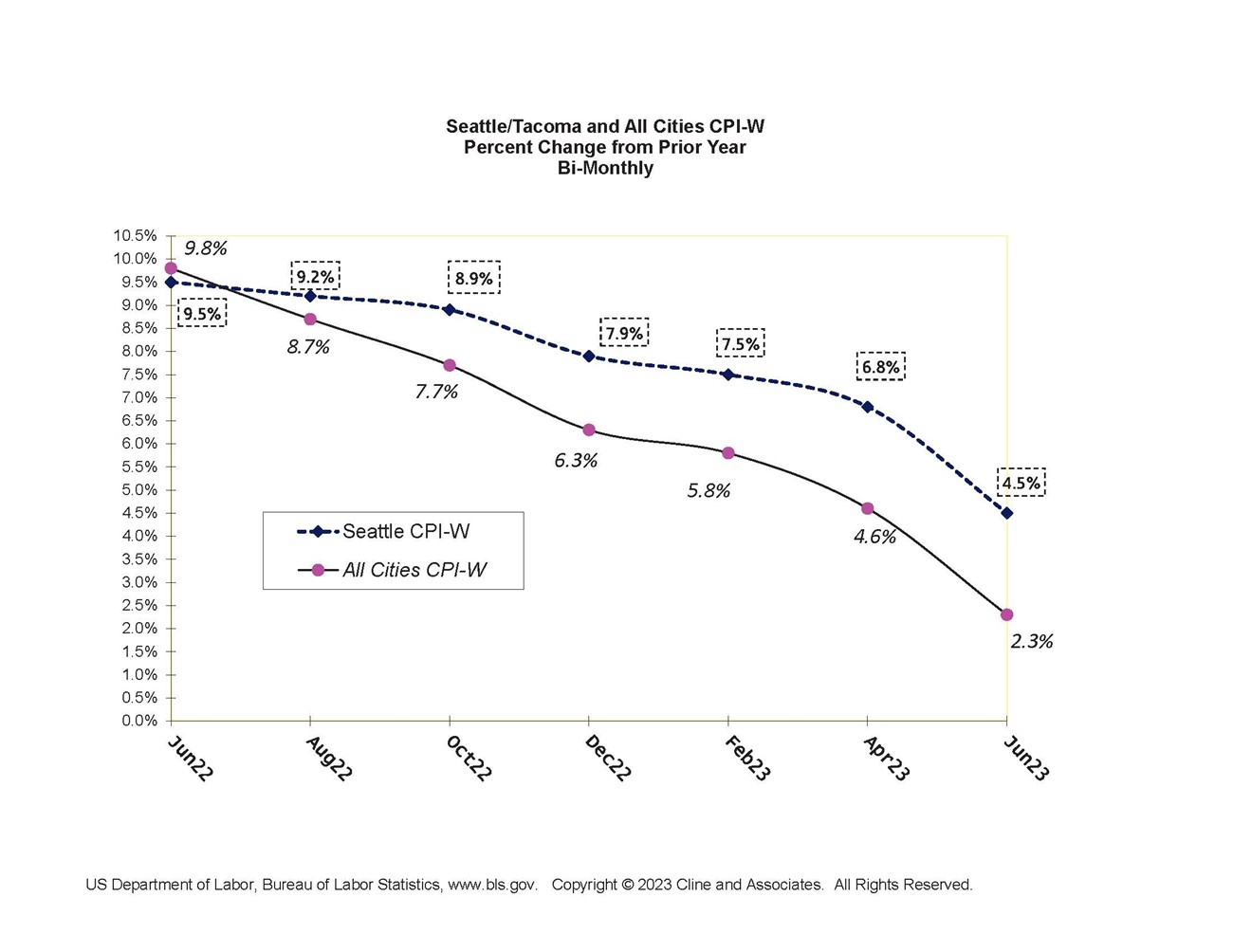

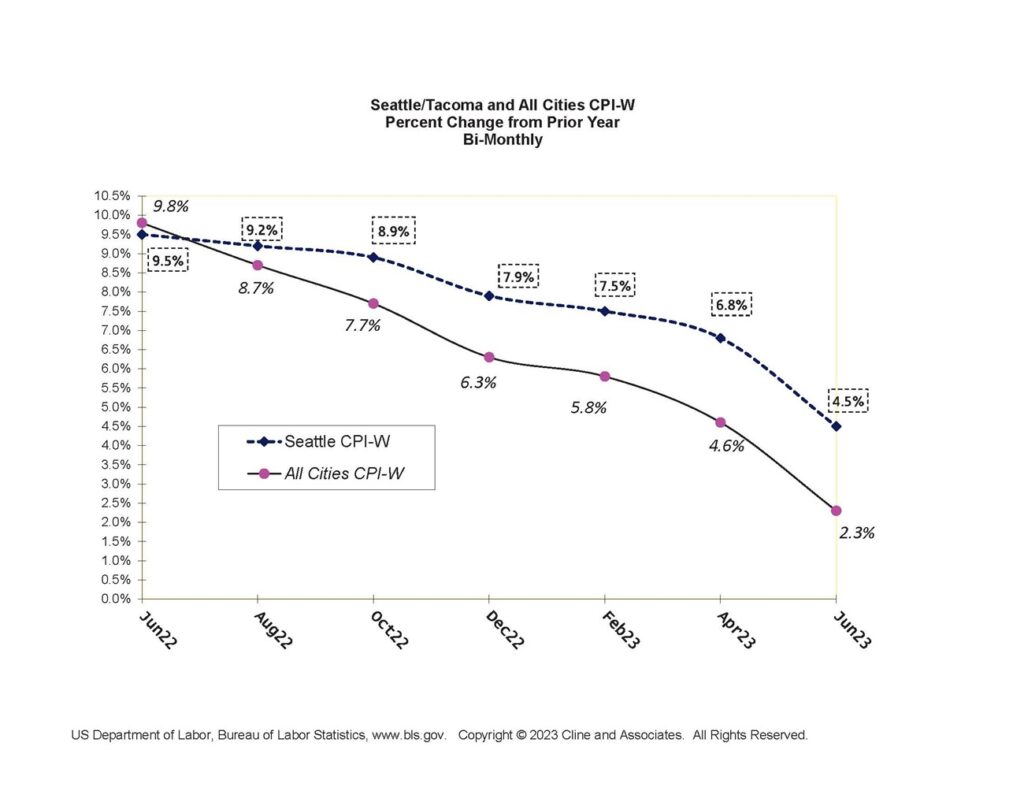

In the last newsletter, we reported on the Bureau of Labor Statistics release of the June CPI numbers. As was noted, over the past 4 months the CPI has slid dramatically, although the Seattle numbers remain high by historic standards and substantially outpace the national CPI indices. The June CPI-W numbers are reflected in this graph:

In the last newsletter, we reported on the Bureau of Labor Statistics release of the June CPI numbers. As was noted, over the past 4 months the CPI has slid dramatically, although the Seattle numbers remain high by historic standards and substantially outpace the national CPI indices. The June CPI-W numbers are reflected in this graph:

Here’s a link to some other CPI indices commonly used in Washington public safety contracts.

We will have some further newsletter articles over the next few weeks reporting on how these CPI numbers impact statewide settlement trends and upcoming contract negotiations. As indicated above, a wide number of contracts in place for 2024 already use a CPI formula. Over the next few days, we’ll be plugging these CPI numbers into our database to run an updated report to show what these formula-based contracts will receive for 2024. Because contracts often use formulas using a “floor and ceiling” or percentage-based limits on the CPI number, the final 2024 number needs to be calculated by applying the formula methods.

We are anticipating producing a statewide settlement report on public safety contracts following these calculations. We will be running a series of newsletter articles discussing the 2023 and 2024 trends (so far) along with a discussion of how we anticipate these CPI developments to impact contract settlements.

In general, a reduction in inflation trends would correlate with a reduction in contract settlement trends. While we expect that correlation to materialize here, there are also a number of other variables that we expect to come into play. Among the positive aspects of reduced inflation (besides the ability of your members to keep up with the cost of living) is that the Fed is expected to temper future interest rate increases which, in turn, would suggest a decreased likelihood of any recession in favor of the sought economic “soft landing.” We are also anticipating that a significant factor in 2024 trends will be that many of the expiring contracts had contained increases far below both CPI and settlement trends with those bargaining units now pushing for substantial “catch up” increases.

Another issue over which we anticipate a fair amount of contention is which CPI index to use. Recently employers have been trying to push back on use of the Seattle index despite its heavy use along most of the I-5 corridor and even sometimes in Eastern Washington. In a number of articles over the past several years, we’ve discussed our view that the Seattle number generally outpaces the All Cities index. Over the past several months that differential has been greater than normal. It’s uncertain how that that gap between the indices will remain, although we expect that ultimately the Seattle numbers will subside considerably to fall closer in line with the All Cities numbers.