By Jim Cline and Kate Kremer

Every month the Bureau of Labor Statistics releases an inflation update on national inflation numbers and every other month they release a “bi-monthly” update that includes regional data, including the Seattle CPI. In mid-March BLS released their report showing inflation through February.

Every month the Bureau of Labor Statistics releases an inflation update on national inflation numbers and every other month they release a “bi-monthly” update that includes regional data, including the Seattle CPI. In mid-March BLS released their report showing inflation through February.

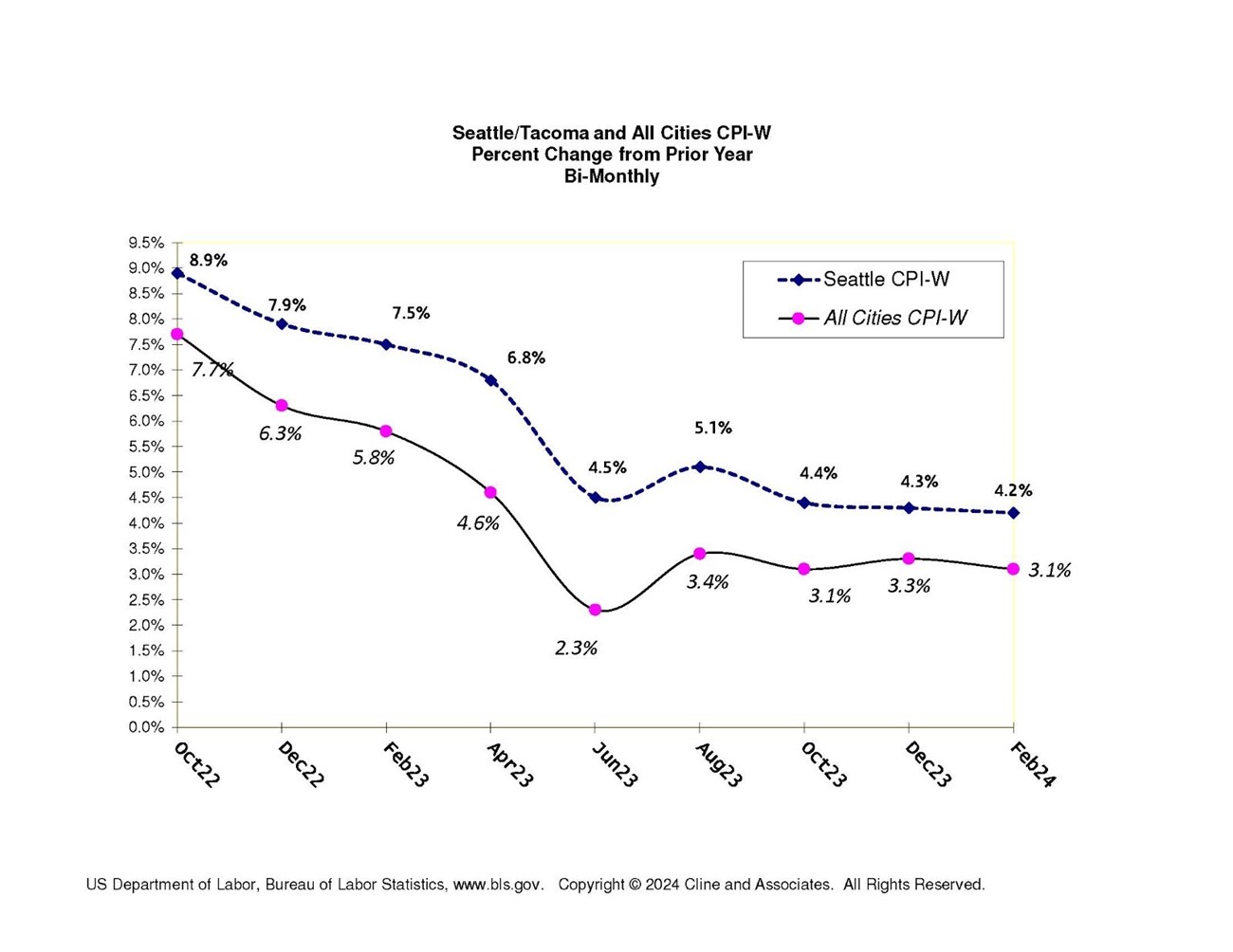

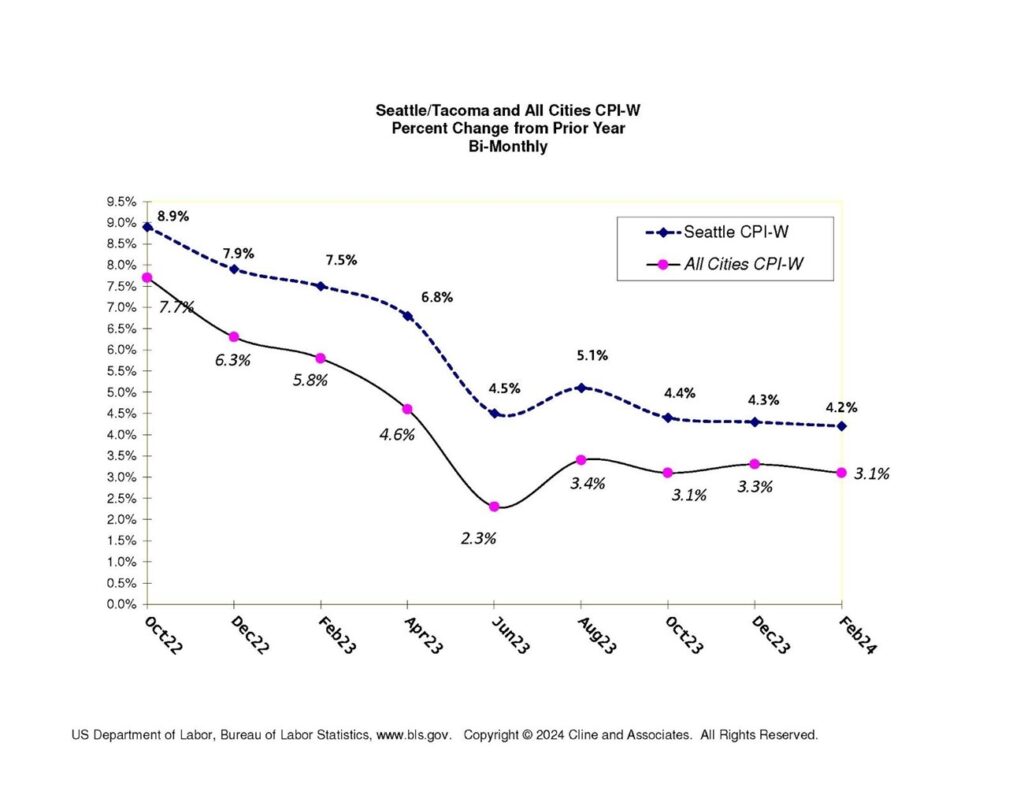

The last few months of data suggest that inflation might be at least temporarily plateauing. These latest numbers also show that the downward trajectory that had the numbers heading closer to the Fed target of 2% is not yet materializing. The latest national numbers are levelling off in the low 3% range. The Seattle numbers are also plateauing, but at about a point higher. The Seattle v. All Cities gap is smaller than it was earlier in 2023 where the gap between the national and Seattle numbers was closer to 2%.

This Chart shows the national and Seattle numbers over the past year on the most used “W” indices:

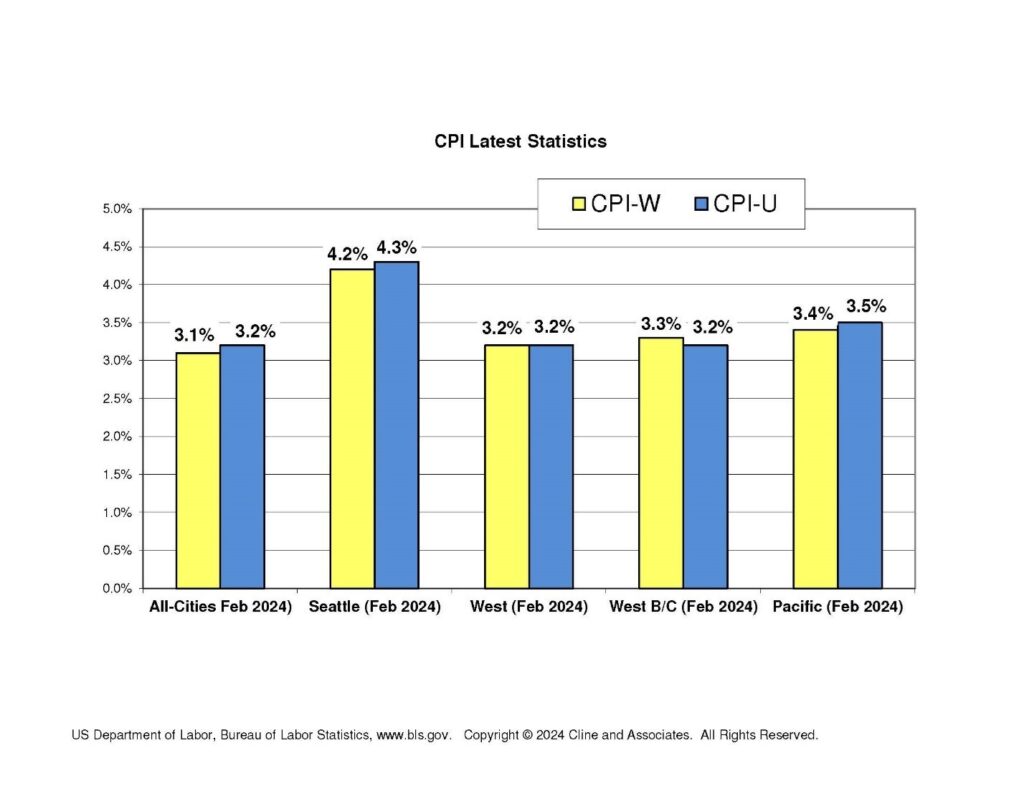

This chart below shows some of the other often used indices including the “U” numbers and the “West Coast” and “Pacific” numbers:

Despite the Fed goal of a return to 2% inflation, there are an increasing number of indications that it may not soon reach that number. While the current near 3% plateau may give way some more, an increasing number of economists are predicting that the longer-term inflation rate will settle in close to 2.5% rather than the 2% goal.

Whether inflation dips further before the important annual June CPI data comes out is hard to say at this point. As we’ve discussed in the past, the June number has special impact on contract negotiations either because comparable contracts are explicitly tied to that number, or where there is no contract formula, the pattern in negotiations, especially for interest arbitration eligible groups, is to rely on that formula.

CPI is an important but not sole factor in the outcome of labor contract negotiations. It certainly is more important in those contracts that are expressly tied to CPI formulas. Notwithstanding lower inflation numbers, we are continuing to see some significant numbers in some of the recent labor contract settlements.

Those trends are not uniform but overall, we are seeing and expect to continue to see a declining trend line in settlement rates compared to the last couple of years. There is a notable trend that those departments that did not score large increases in their previous contract occurring during the high 2021-23 contract years now seem to be landing “catch up” increases.

This “catch up” trend is particularly notable in departments and classifications that have faced significant recruitment and retention issues. While there are some indications that many departments are returning to close to full staffing, there are also widespread indications of departments still unable to fill many spots. Another complicating factor in recruitment and retention appears to be the impact of various “signing bonus” programs. Some departments with vacancies are losing personnel almost at the same rate as they are recruiting.

Earlier this year, we ran some extensive and detailed reports on overall contract settlement trends. We’ll continue to track those trends and provide another update in a few months. We’ll also provide updates on the latest in CPI when that data arrives and assess how that might impact later 2024 and 2025 contract negotiations.

We’ve expressed our concerns about the high number of contracts that tied the out years to a CPI formula. If inflation continues to decline, this will necessarily suppress the overall settlement average because of the increased number of contracts with CPI formulas. We’ll continue to provide updates as they occur.