By Jim Cline and Kate Kremer

This is the second part of our 2023 wage series. In this article, we look at recent contract settlements and examine how those trends vary from previous years.

This is the second part of our 2023 wage series. In this article, we look at recent contract settlements and examine how those trends vary from previous years.

Overview

Our data for 2022, 2023 and 2024 settlements and what we have so far from 2025 indicate that the Washington State public safety employee wages have had significant increases. These increases reflect a response to rising inflation in 2022 and 2023, albeit substantially short of the overall rate of inflation for those years. Mean (average) settlements for those years are well over 5%. Settlements in 2024 are mixed with some positions continuing over 4% in part due to “catch up” from contracts that settled prior to inflation leaving them behind the market. Early settlements in 2025 mirror the decline in inflation, however we do not yet have enough settlements to rely on these numbers as a clear trend.

In this article we’ll provide you an overview and summary of settlements. But for the details of those settlements, you’ll want to explore our Premium Website. If you’re not currently a Premium Website subscriber you can review our services – and contact Carly Alcombrack at Cline and Associates and she’ll explain how you can become one. For current premium subscribers below are links to some of the additional available Settlement Trend reports: Statewide Settlement Trends 2022-2025 and 2023 Wage Survey

Both “mean” (mathematical average) and median (mid-point on the list) numbers are reported. Each has their own significance. Median settlements may be a better indicator of the overall trend as the mean number is sometimes distorted by an occasional particularly high settlement or a large number of 0% settlements.

2022

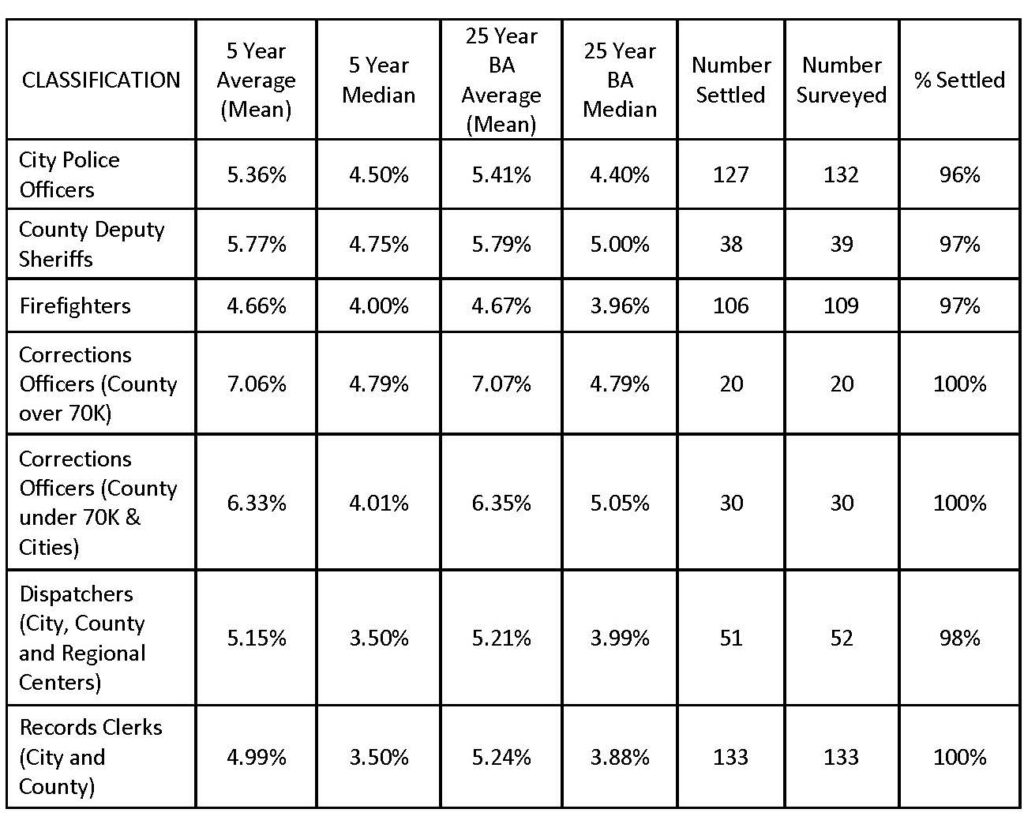

For 2022 we now have most of the wage increases fully negotiated and reported. These numbers seem to reflect labor market pressures. Among all public safety occupations, Corrections Officers report on the high end and Firefighters on the low end, notably below non-interest arbitration eligible groups. We have the following average numbers:

Note that the median numbers are substantially lower than the averages. This indicates that there are some very high settlements that are impacting the overall average settlement figures.

2022 Washington Law Enforcement and Fire Wage Settlements

Averages and Medians

2023

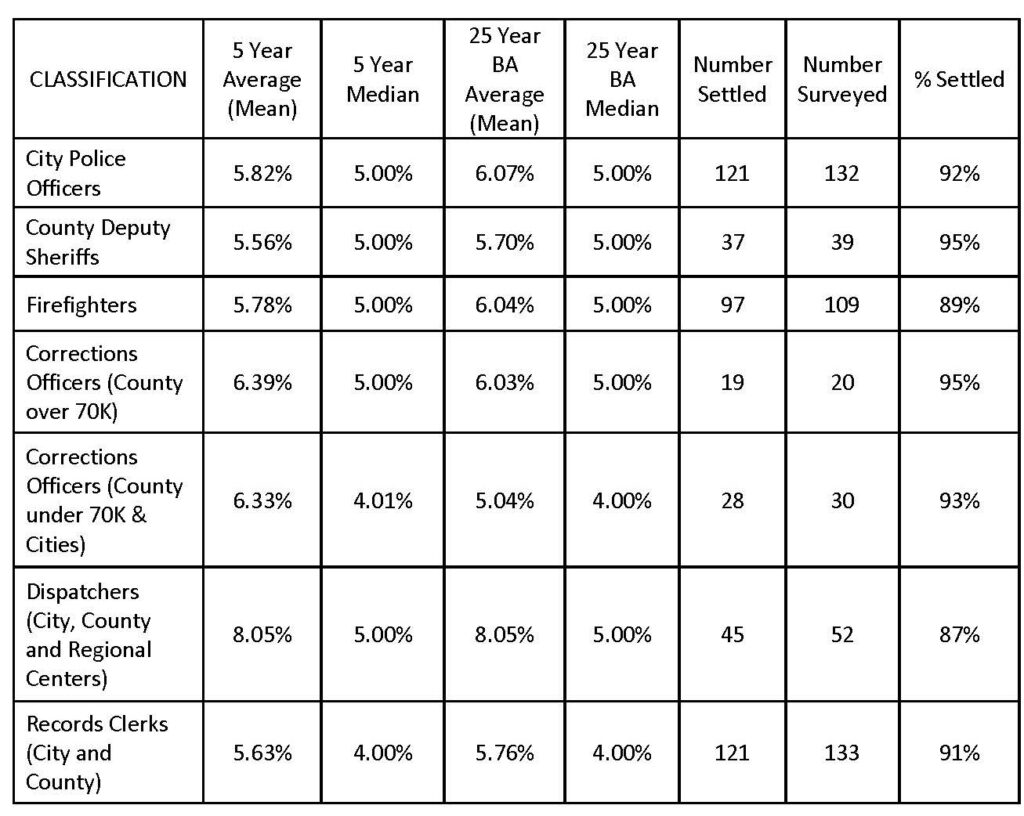

The 2023 table below is also almost complete with 87-95% of the labor contracts now settled. We see the average wage settlements are substantially over 5% for all public safety occupations.

Dispatchers are among the highest, showing an 8% mean settlement. But this result is due to a few very high settlements as reflected by the much lower 5% median settlements for this group. Firefighters, Deputy Sheriffs and City Police Officers show the mean at 5.78 to 6% and the median numbers at 5%. This indicates across the board increases rather than bumps from a few high settlements.

2023 Washington Law Enforcement and Fire Wage Settlements

Averages and Medians

2024

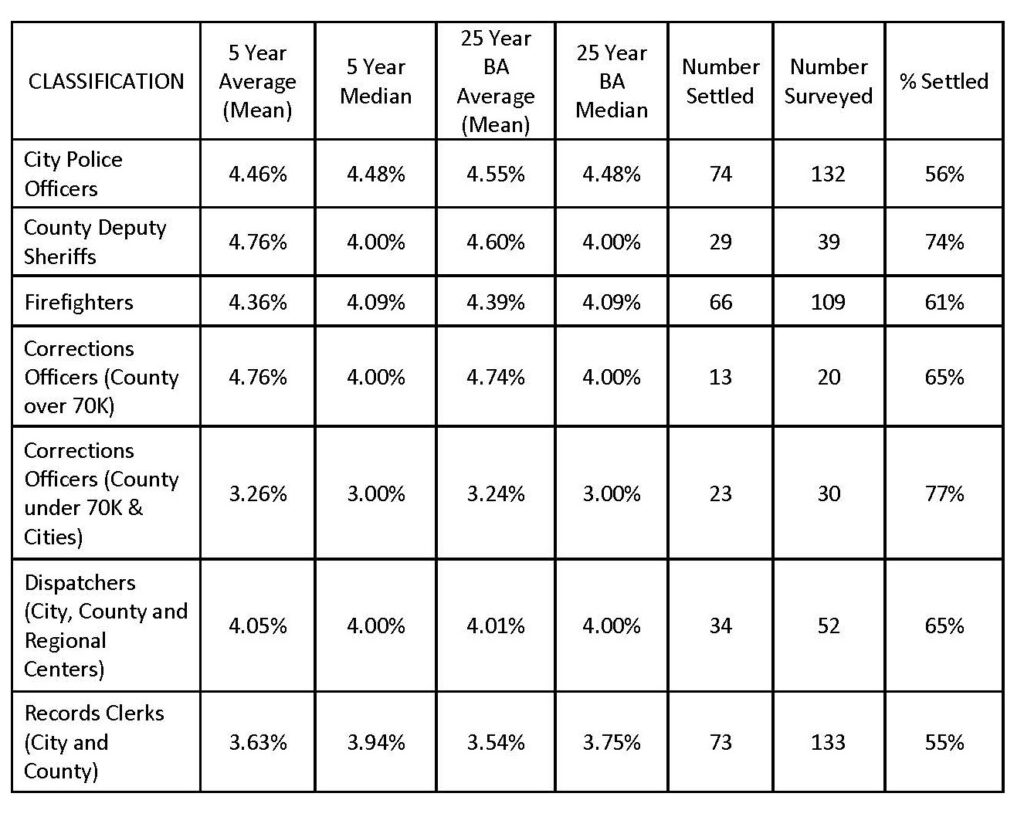

The following 2024 table is an indicator with 55-77% of the labor agreements already settled for that year. A majority of CPI based wage settlements use the June 2023 data and so we have those numbers. 2024 settlement averages are between 3.24 and 4.76%. The results of decreasing CPI figures are showing up in these wage settlements due to the labor contracts with wage increases tied to the CPI increase. An additional factor in wage settlements is the almost universal use of a “cap” when using a CPI formula for wage settlements, especially in the later years of a contract.

In a future article we’ll discuss the pros and cons of relying on CPI formulas in your labor contract. It’s clear that many bargaining units that settled in 2022 and 2023 with the promise of a CPI formula for 2024 ended up shorting themselves. This is a development that we had warned about in previous discussions.

The settlements for 2024 so far show Interest Arbitration eligible groups doing slightly better than non-Interest Arbitration groups, with settlements over 4%. This follows the general trend that interest arbitration eligible groups usually achieve slightly better settlements than non-interest arbitration eligible bargaining units. On the other hand, as suggested by a number of significant Dispatch settlements, staffing shortages and the accompanying labor market pressures are still an important factor in negotiations.

2024 Washington Law Enforcement and Fire Wage Settlements

Averages and Medians

When the average and median numbers are close this indicates broadly distributed wage settlements with few high or low anomalies. This is the case for the settlements in 2024 above. Records Clerks and Non IA Corrections Officer have 3% medians and the remainder of the positions including all the IA eligible groups as well as the Dispatchers have a median of 4% or more. In the case of the City Police Officer the median is almost 4.5%, although nearly half of City Police contracts remain unsettled.

Inflation v Wages and the Impact of “Timing”

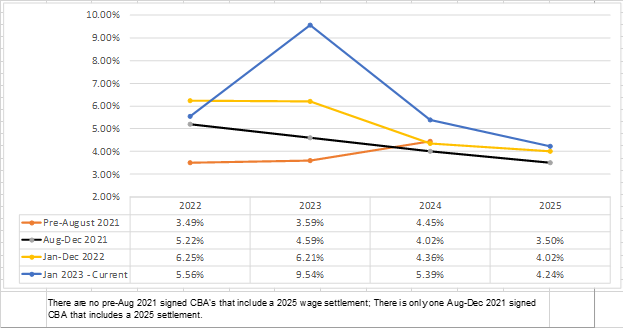

We’ve previously discussed the impact timing had on successful contract settlements, especially early in in the recent inflation spike. To track the impact that the spike in inflation has had on settlements over the past several years, we have tracked settlement trends according to their “signature date” for the City Police Officer position. This chart shows us the settlement increases for contracts signed after the June 2021 inflation increases.

Police Officer 25 Year BA

Comparison of CBA’s signed Pre-Inflation, Second Half 2021, 2022 and 2023

Average Settlements (based on signature date)

The orange line representing contracts signed prior to August 2021 shows the lowest settlements for 2022 and 2023. The black line shows the settlement increase for those signed between August and December of 2021. In 2021 many thought the inflation increase would not last and so those contracts did not sustain the increases in 2023 and 2024. Contracts signed in 2022 and 2023 are substantially higher as higher inflation continued.

This table explains why the settlement tables above for the years 2022-2025 do not tell the entire story. They are influenced by contracts signed pre-inflation with lingering low settlements that do not reflect current economic realities. While contracts generally will not sustain the inflationary settlements, the averages will continue to be influenced by those contracts that were signed early and now need to catch up. A closer look at the settlement pattern makes clear that in many cases, union negotiators failed to recognize and capitalize on the trends that were emerging.

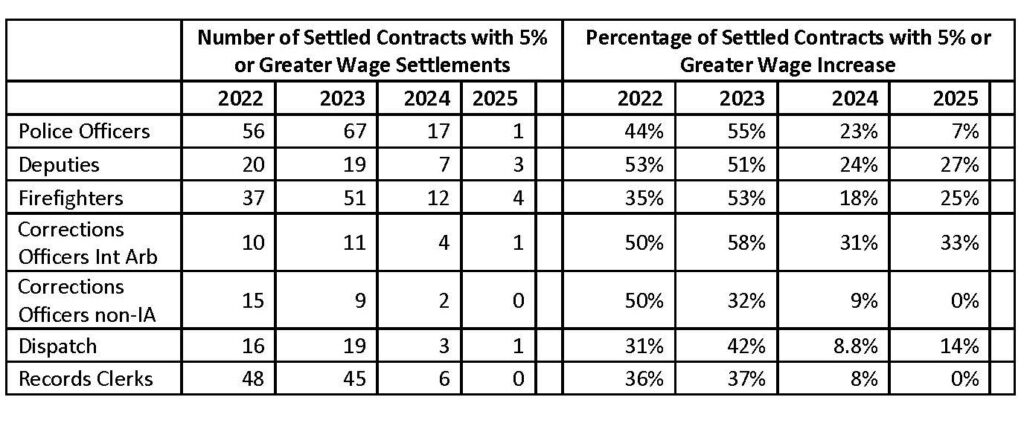

Below is one last table in our settlement trend review. It highlights the recent inflation impacts. Years ago, during the Great Recession, we tracked the number of zero percent wage increases as they proliferated. Today we offer you a glimpse of the settlements over 5%. The rate of 5% or higher wage settlements is up then down, mirroring inflation. The 5%+ settlement rate peaks in 2023. Only about 15% of 2025 settlements are available so that number is not representative of a trend.

With inflation now clearly slowing, what do we expect for future settlements? That’s a topic that we’ll tackle in future articles in this series.