By Jim Cline and Kate Kremer

Spring Blip. For some time, we had been predicting a bump in the upcoming Spring CPI numbers. As the April and May numbers materialized, that prediction proved accurate. The question now is what lies ahead.

Spring Blip. For some time, we had been predicting a bump in the upcoming Spring CPI numbers. As the April and May numbers materialized, that prediction proved accurate. The question now is what lies ahead.

In March we had reported that there would be a likely Spring CPI jump:

In this situation, we often focus on the consensus view that represents the outlook for the broader number of economists. The Wall Street Journal consensus does call for a short-term rise in CPI, jumping up to 2.8% by June before falling closer to 2% by the end of the year. Washington State’s Economic Forecast Council issues its report that shows several national inflation projections and they are in line with the Wall Street Journal – with inflation rise close to 3% this year, before dropping closer to 2% for 2022 and beyond.

We also noted that there was some degree of uncertainty around inflation and that this uncertainly could be a complicating factor in your negotiations planning.

The April 2021 CPI report shows a large jump in the Seattle CPI with an even larger jump in the National CPI. The jump was expected. But the size of the increase exceeded previous predictions, including our own. And this large jump was extended in the May All Cities CPI numbers. (There are no Seattle May numbers as that index is bi-monthly.)

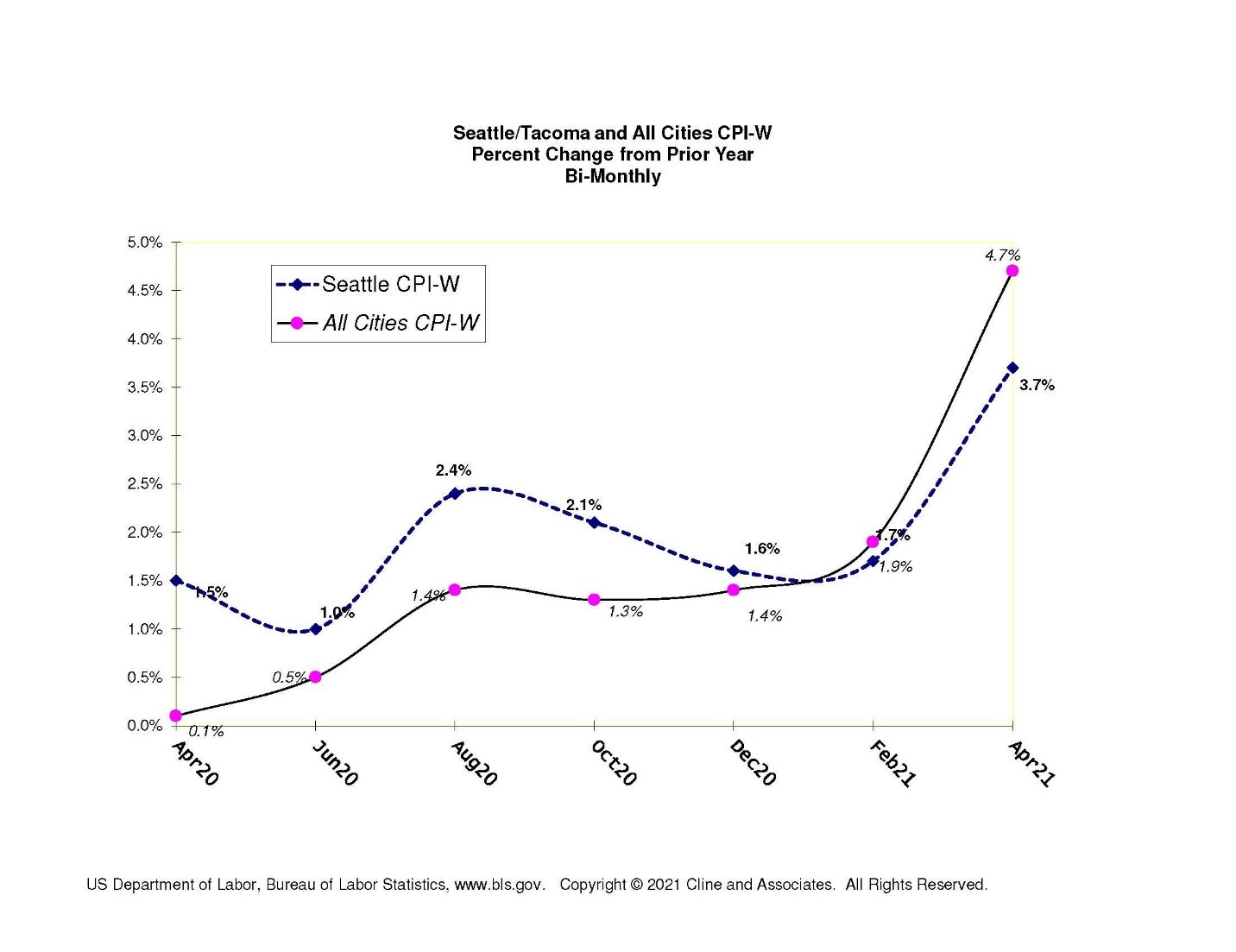

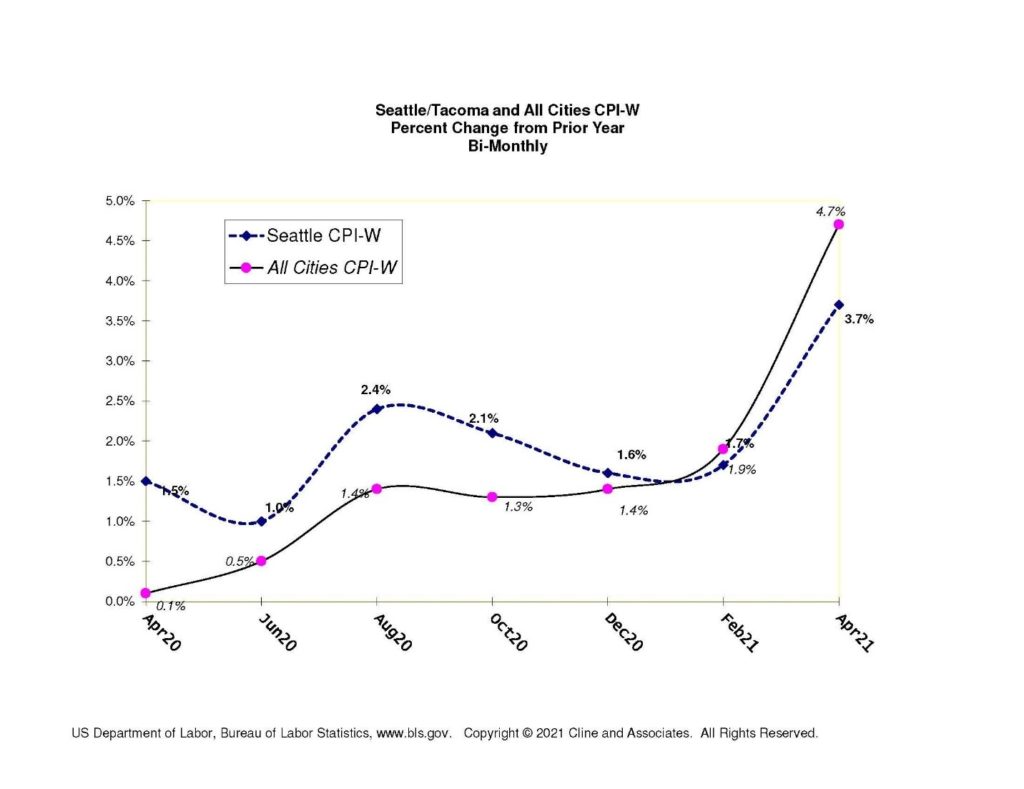

Latest numbers. As this year or year chart shows, the latest April (W Index) number are up to 3.7% for the Seattle index and 4.7% for the All Cities index:

Last week the May All-Cities number was released, and it showed yet another bump. The May All-Cities CPI-W was reported at 5.6%. While there is no Seattle May index, BLS did release the All Cities B/C index, and it came in at a surprising 6.1%.

June CPI Forecast. Previously, we had been expecting the June CPI, both All Cities and Seattle to be in the low to mid 3% range, based on the consensus economists’ forecasts. Based on these latest inflation developments, the All Cities index for June now appears likely to be over 4% and the Seattle index is likely to be over 3.5%.

Impact on Bargaining. What does all this mean for current and future contract negotiations? While some of this Spring inflation was anticipated, this bump is more than expected. The other development appearing in these numbers and that has been a source of widespread discussion among economists is whether the Spring “blip” subsides later in the year, as had been predicted, or carries forward into 2022 and beyond.

The consensus of economists was that inflation would subside in the second half of 2021, likely dropping below 3%. Now, however, there are a growing number of economists predicting that even if inflation subsides somewhat, it will continue at a higher rate than previously expected, possibly in the 3-4% range, or even more. It’s important to understand that some portion of this bump is artificial — this is a bounce back from a lower base 12 months ago in which the CPI number was relatively suppressed. The fact supports predictions that the CPI will subside later in the year. On the other hand, a growing number of economists are concerned that the CPI will not subside and that the current rising costs could start an upward spiral of rising prices.

The inability to safely predict inflation trends is a complicating factor for negotiations. In the short term, as you negotiate your 2021 wage, it is becoming clear that these inflation numbers, in concert with a whole array of economic improvements including the American Rescue Plan stimulus, and an overall tightening labor market (especially including law enforcement) points a 2021 settlement trend greater than the 2019 and 2020 trend. To begin with, the American Rescue Plan has vastly improved the City and County fiscal situation, with fund balances as good or better than existed pre-pandemic. If the June CPI data comes in as expected between 3.5-4.5, you would anticipate that settlement averages would be at least in that range.

Beyond 2021. But what about wage negotiations covering the years 2022 and beyond? This is what the lack of a clear set of inflation predictions complicates negotiations. If employers predict a falling inflation rate in the later years, they certainly won’t want to use the 2021 CPI numbers as a baseline for later years. From a union perspective, though, until there is clear evidence that inflation won’t stay jacked up, offers of less than 3% won’t be very attractive.

It could well be that we are entering a period where the contractual CPI formula becomes mainstream again. From the 1970s until the Great Recession of 2008-2013, CPI formulas existed in most Washington public safety contracts. We have previously discussed the history of how contracts moved from CPI formulas to fixed percentages. Employers wanted budget certainty and unions and their membership were willing to accept the guaranteed increase. With uncertainty in the CPI itself, we think that there some serious reasons to begin considering a return to a CPI formula.

Every contract settlement involves a series of risk management decisions. The uncertainty over the direction of inflation adds on more important consideration to that risk management assessment.

In the next and final article in this wage series, we’ll assess the array of recent developments and make some further predictions and recommendations for the bargaining that lies ahead.