By Jim Cline and Kate Kremer

This is the fifth in our extensive series on current negotiation conditions and trends. In this article, we focus on recent economic developments.

This is the fifth in our extensive series on current negotiation conditions and trends. In this article, we focus on recent economic developments.

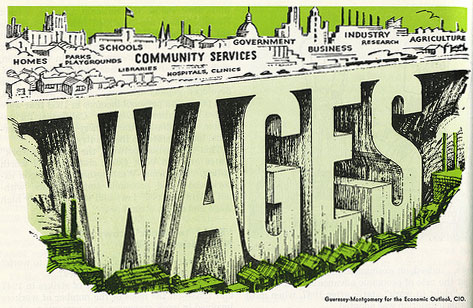

Besides comparables, trends in inflation and contract settlements have the greatest impact on your negotiation circumstances. Close behind that, however, are the economic factors that impact your employer. Those can include general economic conditions, as well as the fiscal conditions that impact their budget. To a large extent, budget conditions are directly impacted by economic conditions, so that’s the topic we’ll address here. In our December article, we discussed the connection between some of these economic and fiscal factors.

The April Washington State Economic and Revenue Forecast, just released this week, is mostly upbeat on statewide trends. The reports includes the following assessment of the current State economy:

- The Washington economy continues to recover from the recession, but growth has slowed.

- Employment growth during the last four months has lagged far behind the November forecast.

- Washington’s unemployment rate declined to 5.6% in February, down significantly from the 16.3% rate reached in April 2020.

- Washington housing construction increased in early 2021 to levels not seen since the mid-2000s.

- Washington exports continue to decline, mostly because of transportation equipment.

- Washington personal income growth was sustained by extraordinary fiscal support in 2020.

- The decline in Washington real GDP in 2020 was mild due to a favorable mix of industries.

- Seattle consumer price inflation matched the national average.

- The Washington forecast features higher personal income and housing construction but lower employment and inflation than did the forecast adopted in November.

National indications are also bright. Among some key indicators:

- The US Manufacturing PMI shows “the second highest growth record in history.”

- The consensus projection of Wall Street Journal’s panelist of economists projects a 6.0% increase in GDP for the year.

- The same panel expects unemployment to drop to 5.0 by the end of this year and 4.5%, which is virtually “full employment” by 2022.

- The Federal Reserve bank appears committed to maintaining low interest rates until the economy fully recovers.

Ultimately, this robust economy recovery will lead to rising tax revenues. Those revenues will be on top of the recent infusion of cash virtually all state and local governments just received. All together the “American Rescue Plan” legislation contained $350 Billion for State and Local governments. Of those funds, Washington State government received $4.253 Billion, Washington Cities received $700 Million, the 39 Counties received $1.477 Billion and other Washington local government agencies received $483 Million. As the New York Times described the situation:

“It is a very different picture from one year ago, when state and local governments predicted collapses in revenue and slashed their spending, accordingly, laying off park workers, teachers, and sheriff’s deputies. But in an unexpected twist, revenue in most states did not drop nearly as much as was predicted, and now governments are going into their budget-making season with a markedly brighter sets of numbers. According to Mr. White, 31 states now have enough cash to fully absorb the economic stress of the pandemic recession on their own.”

Washington State has fared particularly well compared to other states. This one time infusion of money restores Washington’s revenue to exactly where it was pre-pandemic. This outlook is reflected in the March State Economic and Revenue forecast.

In future articles as we get close to the end of this Wage and Negotiations series, we’ll come back and address all the various economic and fiscal factors, and other trends and discuss how they will impact your negotiations.