By Jim Cline and Kate Kremer

T his is the first of an eleven-part series addressing current economic conditions and wage settlement trends. In this Spring 2013 Wage Series, we’ll bring you an update on CPI and economic developments, wage settlements, interest arbitration trends, statewide wage rankings for public safety classifications across the State, and an in-depth analysis of what factors appear to be impacting those rankings and settlements.

his is the first of an eleven-part series addressing current economic conditions and wage settlement trends. In this Spring 2013 Wage Series, we’ll bring you an update on CPI and economic developments, wage settlements, interest arbitration trends, statewide wage rankings for public safety classifications across the State, and an in-depth analysis of what factors appear to be impacting those rankings and settlements.

We will provide you a good overview of those trends but for the most detailed and complete look at wage rankings and settlements, you’ll want to explore our Premium Website. If you’re not currently a Premium Website subscriber, contact Darrah Hinton at Cline & Associates and she’ll explain how you can become one.

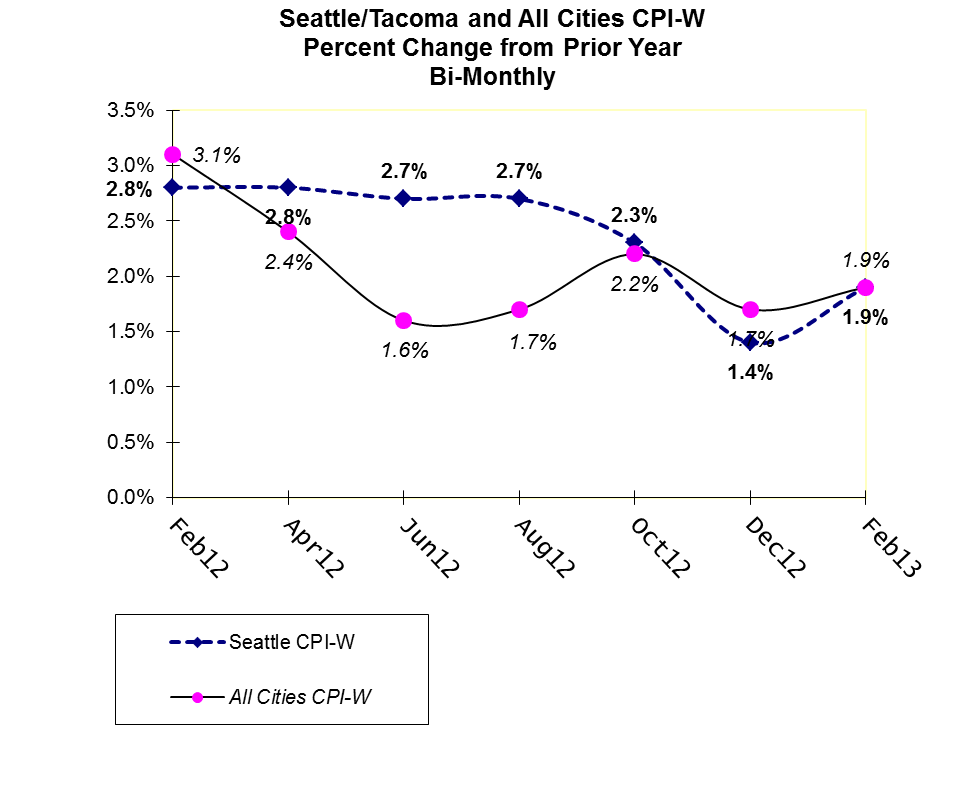

We start with the newly-released February 2013 CPI numbers. The last CPI report placed the All-Cities index somewhat above the Seattle index, but the February 2013 CPI shows the Seattle and the National W index tied at 1.9%. This number involves an increase from two months ago, primarily recognizing the recent jump in energy prices. Overall, this seems to reflect a trend that we’ve discussed, for the CPI to trend towards 2.0%. This represents a drop from the February 2012 CPI as depicted on the following 12 month CPI graph:

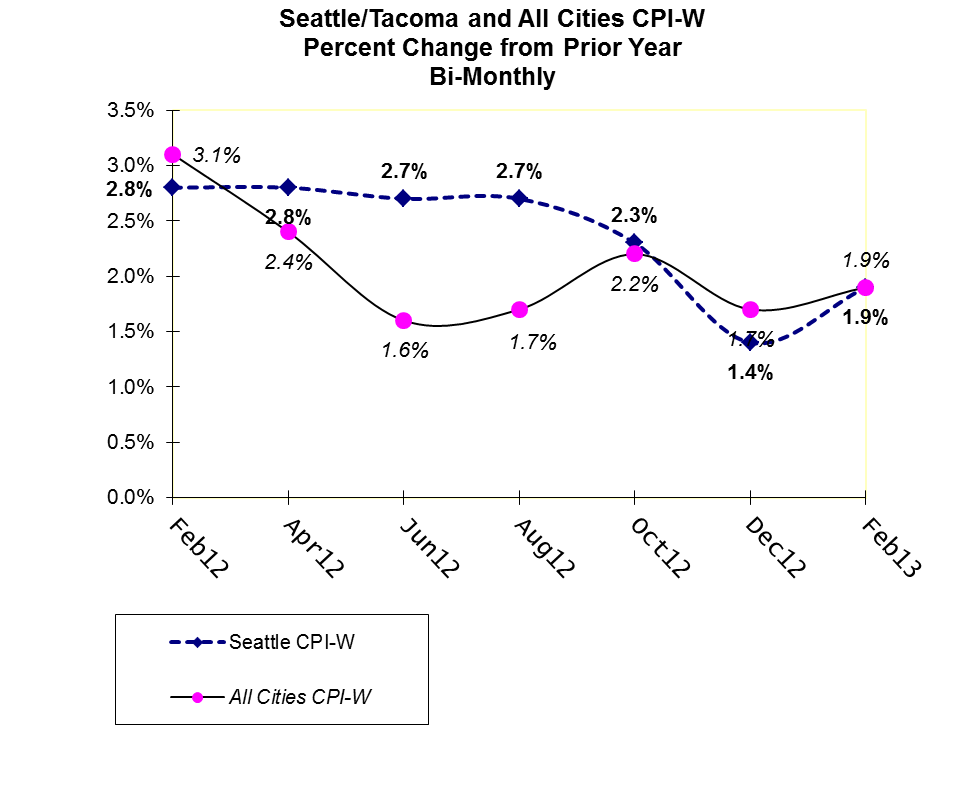

Here’s a graph showing other CPI indices commonly used for Washington public safety labor contract negotiations:

| CPI INDEX* | CPI-W | CPI-U |

| All-Cities (Feb 2013) |

1.9% |

2.0% |

| Seattle (Feb 2013) |

1.9% |

1.8% |

| West Coast (Feb 2013) |

1.9% |

2.0% |

| West Coast-Class B/C (Feb 2013) |

1.4% |

1.5% |

| Portland -Salem (Second Half 2012) |

1.8% |

2.1% |

As we’ve discussed, the predictions of the Federal Reserve Bank for inflation near 2% for the next few years and those Federal policies seem to reinforce that goal. While unexpected inflation spikes might arise, especially when driven by difficult to anticipate gas price increases, we are building our negotiation outlook on an assumption that the CPI will likely trend towards 2%, at least through 2014.

While any prediction in this arena is uncertain, macroeconomic indicators at this point do not point to a likely return to either 3% plus inflation, or 0% inflation in the very near term. Whether inflation eventually will return to its historic 20 year, 3% average remains to be seen. The policies of the Federal Reserve Bank seem to indicate an intent not to allow inflation to float to that level, but rather to maintain it near 2%. If the economy heats up significantly, though, the Federal Reserve Bank may have difficulty preventing inflation from returning to 3% or higher. Accelerated economic growth almost invariably increases pressure on the inflation rate. The larger question now, is when will the economy resume rapid growth and shake off its current tepid growth?

As you assess your potential 2013, 2014 and even 2015 wage offers, you’ll want to factor in these predicted trends as all data and experience suggest that CPI rates are the biggest predictor of wage settlement trends. In the next article in this series, we will discuss current settlement trends and later, we’ll discuss other factors and what they mean for your contract negotiations outlook.